If I have a house, apartment, rooming house, etc that I rent do I need a Business Tax Receipt?¶

The City of Tax Code requires that property owners and/or agents operating any of the above with the object for private gain, benefit or advantage, either direct or indirect, obtain a Business Tax Receipt and pay the required business taxes.

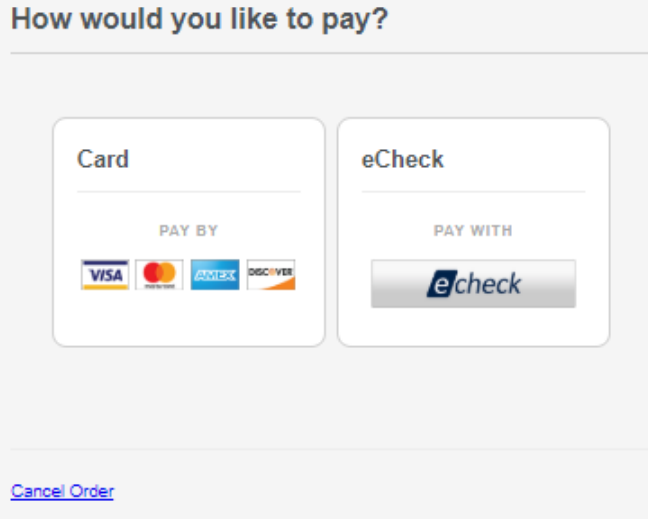

Application for business taxes (not rental certificates) may be made by using our Business Tax New Business Application Service

Effective May 4, 2023 the requirement to obtain a rental certificate or register a rental property was repealed. The Business Taxes are still due for all residential and commercial rental properties.