Housing Affordability Advisory Team Introduction

On August 21, 2019, Mayor Castor kicked off the Housing Affordability Advisory Team. The challenge for this team was to recommend approaches to address housing affordability in Tampa and to integrate these recommendations with other Mayoral priorities.

The team evaluated a broad range of ideas including, but not limited to, increasing the supply of housing; revising zoning and land use regulations to provide for more multi-family and studio apartments and higher density in certain parts of the City; and incentivizing the development of more workforce and mixed-use development while improving regional transit mobility.

The team also assessed the role the City has had in facilitating affordable and workforce housing initiatives. In just the past two years, the City has invested more than 25 million dollars into housing affordability through a variety of assistance programs. Many of these programs are highlighted in this report, and those that have demonstrated success will be continued. In large part, the team identified many initiatives and programs that can promote housing affordability across many stakeholders. In some cases, existing programs need to be simplified and promoted or better coordinated to achieve maximum results. In other cases, the team identified new ideas or emphasized the need for Mayoral leadership to boost old ideas that have not adequately been implemented.

Ultimately, the group focused its recommendations on the following subject areas:

![]() Supply and Programming

Supply and Programming

![]() Policy and Alignment

Policy and Alignment

![]() Community Outreach and Engagement

Community Outreach and Engagement

View the Recommendations and Final Report (PDF)

View the Urban Land Institute (ULI) Recommendations Report (PDF)

Factors Influencing Housing Affordability in Tampa¶

Population Growth

Tampa is a fast-growing city, offering an appealing quality of life that is attractive to newcomers. New residents are drawn to its strong economy, moderate climate, vibrant culture, and rich history. Since2000, Tampa’s population has grown primarily as a result of an influx of newcomers. The Tampa Bay Times reported in 2019 that nearly one-third of the area’s newcomers came from outside the continental United States, many as a result of recent hurricanes in the Caribbean.

According to the Census' American Community 2017-18 survey, Tampa is the third most populous city in Florida. See the chart below. Furthermore, the Tampa Bay Region is one of the top ten fastest-growing metropolitan regions in the U.S. The City’s economy is strong and growing, attributable to many large employers such as Amazon, Bristol-Meyers Squibb, USAA, Mosaic, and others that relocated to the area. While population growth typically represents prosperity in a community, it often comes with unintended consequences such as increased traffic congestion, rising housing costs, and related strains on infrastructure.

Tampa Population Growth

population data extracted from the Census’ American Community Survey 2017 5-year estimates and the Census’ 2018 Population Estimates

Construction Boom

Tampa’s influx of new residents has been, in part, spurred by the growing economy which has led the state in job growth multiple times over the last few years. As companies move into the area, both commercial and residential construction has increased.

Tampa’s skyline is rapidly changing as developers move to meet the demands of consumers. This increase in construction has resulted in higher demand for labor and higher cost as contractors and projects compete for a limited labor pool. The City’s ‘Owner Occupied Rehab’ program has suffered from this dynamic. The program typically operates with more than a dozen qualified contractors, however, at this time, there are only four. This results in residents having to wait more than six months for projects to be completed that would typically take less than three.

While the housing boom is generally beneficial to the community, less than 5% of the residential permits issued in Tampa in 2019 were for Affordable Housing units.

Market Changes

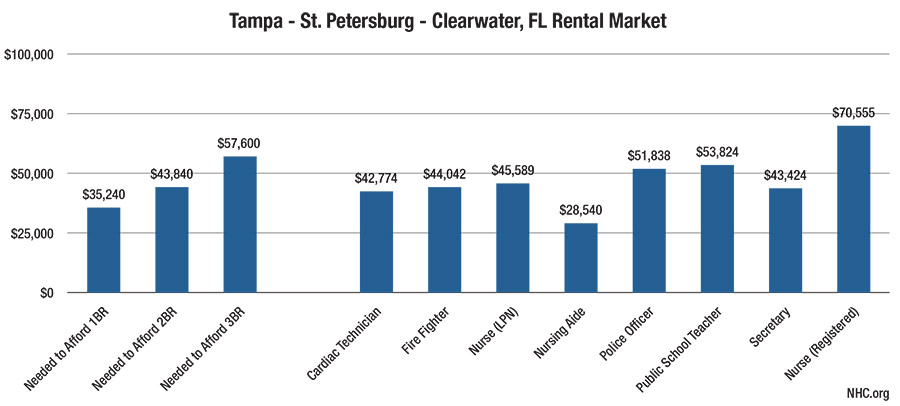

Tampa’s market is changing as well. Although wages are growing, many of the residents in low-income census tracts lack the skills necessary to compete for higher-paying positions. According to the most recent ALICE (asset-limited, income-constrained, employed) data, the annual household income needed to afford the market rate of an average one-bedroom apartment is more than $35,000. This is more than twice the income earned from minimum wage. As Tampa continues to thrive and grow it is incumbent that this community takes steps to ensure that housing is affordable and the supply is adequate to meet the demand.

General Findings¶

The Advisory Team identified numerous tactical and strategic recommendations that are set forth more fully in this report. The Team also identified several foundational recommendations that are set forth below. These recommendations were identified as critical to achieving the overall vision for this Mayoral priority.

- Define the Concept. The term “affordable housing” is frequently misunderstood and misused. The federal Department of Housing and Urban Development (HUD) defines an “affordable dwelling” as one that a household can obtain for 30 percent or less of its income; or conversely, a household that spends more than 30% of its income on housing is deemed ‘cost-burdened.’ There are many ways to measure housing affordability, however, the Advisory Team opted to focus its efforts to identify solutions that could serve a broad community.

For that reason, the team chose to define the concept they were tackling as housing affordability -- a generic but more inclusive term to describe its objective. - Define the Need. The Team acknowledged that Tampa is experiencing a growing housing affordability issue; however, it struggled to precisely define the problem in terms of empirical data. It was agreed that a comprehensive understanding of the need was necessary to set forth meaningful and measurable targets. As such, the Advisory Team recommends that the City of Tampa, in partnership with Hillsborough County, undertake a comprehensive needs assessment to definitively determine current and projected housing needs. The assessment should take into consideration employment- and transportation-related needs, which in many cases, are inextricably linked to housing affordability. It should also consider preservation and restoration needs, as well as the duration of certain affordability support programs. The assessment should more accurately identify the number of housing units needed at different income levels in different neighborhoods, as well as what types of units are most appropriate in specified locations. A comprehensive needs assessment should seek to answer the following critical questions:

- How many units are needed to fill current and projected demand?

- What income levels need to be accounted for?

- What types of units are required?

- What locations are most suitable?

- Prioritize the Need. The Mayor should continue to elevate housing affordability as a City priority and seek the support of local and regional influencers, organizations, employers, and advocacy groups. There should be a specific focus on working with the Economic Development Council and the various Chambers of Commerce (Tampa, Black, Hispanic, etc.) to include Housing Affordability as a critical strategy for continued economic growth and community empowerment.

Advisory Team Recommendations¶

To ensure that Tampa residents have access to housing they can afford, it is critical that the supply of housing meets the demands of a rapidly growing population.4 For more than a decade, the number of new residents moving into Tampa has outpaced the number of new housing units built. Last year, nearly 900 permits were issued for new residential homes, only 40 of those permits were classified as ‘affordable housing.’ This limited supply has led to both increased rents and higher sales prices in almost all of Tampa’s neighborhoods. This growth has led to gentrification in some neighborhoods as middle-income families compete with lower-income families for the same pool of available housing. At the same time, the supply of public housing and subsidies has failed to keep up with the level of need. City policies, including land use, should encourage the development of an adequate supply of housing that residents can afford.

The Tampa Bay Times recently reported, “Those waiting for public housing are among the community’s poorest. They include veterans, the disabled, and the elderly. To qualify, a family of four must have a household income of no more than $34,000. At present, more than 25,000 people are on Tampa Housing Authority’s waiting lists for either public housing or a housing voucher. The average wait time is up to a decade.”

According to the 2019 Homeless Count in Hillsborough County, on any given night, there are at least1,650 homeless men, women, and children in Tampa-Hillsborough County. These are people who are sleeping on the streets, behind buildings, in encampments, in cars, in available emergency shelters, and in transitional housing.

Unfortunately, the list of negative statistics in this area is long. The Advisory Team recommends a series of immediate and longer-term actions to reverse the trends driving homelessness and lack of housing affordability. Those recommendations are outlined in three sections, the details of which follow.

Section 1. Housing Supply and Programs

Section 2. Policy and Alignment

Section 3. Community Outreach and Engagement

Section 1. Housing Supply and Programs¶

Recommended Action Items

The notion of supply and programming runs across many aspects of housing affordability, including having adequate housing available to meet demand, having sufficient funds and resources to buy, build, and maintain the supply, and having effective programs in place to bridge the gap between the supply side and the demand side of the equation. The following is a series of recommendations in this area.

- Increase the supply of Housing Units

Housing affordability is a challenge primarily driven by market trends, limited supply, and high demand. When demand outstrips supply, housing prices rise. The City and its partners have initiated numerous programs over the years to counteract the harsh supply and demand cycle, including the addition of more affordable units in a wide range of locations including Nehemiah (Sulphur Springs), Beacon Homes, and Genesis (East Tampa), Encore (Downtown North), and Southland (South Tampa). Notwithstanding the success of these programs, it has not been enough to stem the growing gap between supply and demand which exacerbates the lack of affordability.

One of the City’s challenges is the constraints that exist as a result of its current direct approach to managing land and real estate, as well as the distribution of certain financial resources. The advisory team explored a range of best practices in use by other jurisdictions across the country that have enabled greater flexibility and adaptability to evolving needs. There is no one-size-fits-all solution so it is crucial to have tools that can open the door to deploying more innovative construction methods and materials and encouraging a wide variety of home sizes and types.For this reason, the Advisory team recommends initiating two new programs that have had positive results enabling a wider range of solutions in other jurisdictions – a Community Land Trust and a Housing Trust Fund.

Community Land Trust

A Community Land Trust is a tool used widely around the country to enable more flexible solutions for tackling housing affordability. It is typically used to secure land and vacant property for the purpose of converting it to achieve housing affordability goals. The use of this land can be managed more comprehensively - and strategically - through the governance of the Trust.An effective Community Land Trust (CLT) would ensure a wider geographic distribution of housing affordability across the City and beyond. By representing a wide range of stakeholders and having a macro view of the needs and opportunities, the CLT would use a more needs-based strategy for the placement and type of housing units. In addition, the CLT could drive the availability of new rental units as part of Tampa’s housing affordability inventory. Ultimately, the CLT would be well-positioned to map the types and availability of housing throughout the city and develop a strategy to address gaps.

Moreover, the CLT could be instrumental in driving the adoption of policies in the City, and beyond, that support housing affordability goals. For example, specific policies can drive down the cost of building and renovating housing units which directly translates into housing affordability. Policies concerning fees associated with construction, including impact fees, can have a tremendous effect on the bottom line.

The advisory team strongly recommended exploring best practices for the methods, policies, and procedures to ensure effective controls and accountability for a CLT. To be most effective, the tool must have a clear vision, mission, and measurable goals.

Housing Trust Fund

A Housing Trust Fund (HTF) provides an opportunity to grow and strategically manage a base of financial resources that can be used to plan, design, and build new residential units. The challenges facing Tampa in funding housing affordability initiatives are not unique. Every day, Tampa residents who purchase homes contribute Florida Doc Stamp revenue to the state’s Sadowski Trust Fund which is intended to augment municipal funding associated with housing affordability programs. However, year after year, more and more of the Sadowski funds have been diverted to the state’s general budget, forcing cities to have to identify other funding sources.

In spite of this, there is hope. Tampa’s Community Redevelopment Districts generate revenue, part of which can be prioritized for housing affordability. There are also opportunities to work with Hillsborough County and the private sector to address the issue.

That is where the HTF comes in. An HTF could be used to formally accept and manage contributions for specific purposes and programs, manage and grow the corpus, and develop a sustainable housing affordability budget that is not subject to the fluctuations of state and federal funds. Moreover, the HTF could be used to achieve critical mass around financial resources, whereas today support dollars tend to be distributed across many meritorious, but disparate organizations.

Like the CLT, an HTF can provide greater flexibility for communities to meet their specific needs such as the family that earns too much to receive housing aid, but not enough to actually afford suitable housing. These ‘need gaps’ are nearly impossible to fill with federal or state funds which typically have restrictive qualifying criteria. The funds in an HTF would not be subject to these limitations.

For these reasons, the Advisory Team recommends that the City develop a Housing Trust Fund with a preliminary base of $8 million and a goal of $40 million within eight years.

Typically, an HTF starts with a base of funds derived from multiple sources. The funds are invested to drive positive returns and grow the account balance. The bulk of the funds are used to build homes that are then sold, and a portion of the proceeds of the sale are used to repay the contributors at the end of a designated period.

The Advisory Team recommends that a substantial portion of the base funds should come from private sources, specifically corporations and local employers who rely upon the talent and workforce to achieve their success. Contributing to a housing affordability solution that enables the local workforce to live near where they work is a fundamental component of a prosperous and resilient City and should be a leading driver for all Tampa employers.

Another funding source could be established through a partnership with Hillsborough County. The Hillsborough County Commission recently committed $10 million toward housing affordability solutions. It would be a significant step toward a long-term sustainable solution to have the City and the County formalize collaboration and a partnership in strategically deploying these dollars back into the community.

An additional source of funding could be the City’s Community Redevelopment Area (CRA) budget. The CRA Board recently voted to have its staff research the feasibility and effectiveness of dedicating a specified portion of each CRA’s budget to help create more affordable housing. The use of CRA funds for this purpose is supported by the Community Redevelopment Act (Chapter 163, Part III, Fla. Stat.) which promotes the creation of affordable housing and allows community redevelopment funds to be used to develop such housing within community redevelopment areas. It should be emphasized that funds contributed by a CRA would be specifically earmarked for use in that CRA’s geographic allocation.

Like the CTF, the advisory team strongly supported having specific production targets and meaningful standards and controls to ensure the highest level of effectiveness and accountability in the development and management of a fund of this nature.

- Set achievable and measurable targets

- Accelerate the addition of 10,000 Housing Units by 2027

Through a variety of programs and initiatives, the City has, over time, added to the supply of housing units serving a wide range of income levels and needs. This past year, the City introduced new programs and new partnerships and collaborations which resulted in a significant increase in the number of units produced. The Advisory Team recommends that the City, in partnership with all relevant organizations and agencies, increase the types of programs that accelerate the process, diversify the types of units made available, and target the addition of 10,000 Housing units - spanning all income levels - by the end of 2027.

Income Levels and Percentage of Housing Units Income Levels Suggested Percentage of Housing units Very Low Income (0-50% AMI) 30% Low Income (51-80% AMI) 40% Workforce Housing (81-140% AMI) 30% - Restore and preserve at least 100 existing Housing Units annually

The City should work with organizations such as Rebuilding Together Tampa Bay, Inc. (RTTB), Habitat for Humanity, and others, to secure funding to assist property owners who have code violations due to rehab issues. The City could explore replicating restoration programs such as Program Operation Code-Vet through Hillsborough County and can work with home improvement stores (local and ‘big box) to have them provide hands-on home maintenance classes to help educate homeowners on how to reduce repair costs through more routine maintenance.

- Accelerate the addition of 10,000 Housing Units by 2027

- Expand the use of successful Housing Affordability programs

The City of Tampa distributes approximately $10 million a year toward housing affordability programs. Several recommendations relate to ensuring the continued success of these programs. The Advisory Team emphasized that these programs should remain in effect and should be routinely assessed to ensure maximum effectiveness and aggressively promoted to increase awareness.

The primary programs identified for continuation are set forth below.- Rental Subsidy Program

The City provides two unique programs serving different community needs. The ‘Rental Subsidy Program’ distributes funds to qualified applicants to offset the cost of rental and utility deposits. The ‘HOME Tenant-based Rental Assistance program’(TBRA) provides rental support for up to one year for individuals emerging from homelessness.

There are many ways to expand these programs for some of the City’s most deserving recipients, including seeking alternative funding sources that would enable families earning between 80 and 140% of AMI to qualify; encouraging employers to more actively promote the programs to their eligible employees, and implementing programs that educate employers about programs that can help their workforce fulfill their housing needs. - Dare to Own the Dream Program

The City provides down-payment assistance to individuals and families that purchase a home within the City Limits. The program provides assistance to families who earn up to 140% of the Area Median Income (AMI). It was widely regarded as a successful program that should be continued. - Owner-Occupied Rehabilitation Program

This program provides funds for home repairs such as roofs and major system repairs which enable a homeowner to sustain their home. The advisory team recommended exploring feasible options to expand the eligibility for families who earn up to 120% of the AMI. - Vacant Land Re-purpose Program

The City will seek to expand this program which re-purposes vacant land that has been the subject of foreclosure, typically due to long-standing code enforcement liens. The land can then be designated for housing affordability purposes. The recommended Community Land Trust is one method to establish comprehensive policies for the development and transfer of these lands. - In-fill Housing Program

In-fill housing has typically been an attractive tool for community redevelopment and growth, helping to offset the costs associated with urban redevelopment where land can tend to be more costly and properties often need substantial rehab. In-fill housing can also be an essential component of interconnectivity across a community. The City’s program provides funding for construction, as well as reduced permitting fees and Lot Readiness Funds, all of which contribute to a more affordable home.

- Rental Subsidy Program

- Identify new Housing Affordability programs

- The City will encourage large employers to develop programs whereby the employer invests in specific housing assistance programs as part of individual employee compensation packages.

- The City will consider policies and pilots that enable new and emerging housing materials and types including pre-fab housing, tiny homes, container homes, and others. The City could tap into successes achieved in other jurisdictions across the country, and work with tiny home/container housing developers to identify opportunities on available lots owned by the City of Tampa.

- The City will develop a land map that identifies land and properties that may be considered for housing affordability programs including City-owned vacant and/or underutilized land and land owned by other governmental entities such as the school board, county, port, etc.

- Ensure accountability

Every organization that receives City housing affordability funds or other resources should be routinely evaluated for its performance in achieving its objectives. Further, the City should develop a process and policy whereby organizations must meet minimum performance standards to remain City-approved.

The City will assess the qualifications and exceptions for each of the City Housing Programs and retool, where appropriate, to meet the goals and vision of this administration and the Advisory Team recommendations.

For City-sponsored programs that award contracts to developers to build affordable housing, the City will set program criteria to enable a wider range of developers/builders to qualify. In addition, the City will ensure qualifying criteria are clear, concise, and transparent; clarify the approach used for selecting existing builders for current programs; and increase the transparency of the process, the selection criteria, the measures of performance for the selected builders, and the outcomes of the program over time.

- Mitigate negative impacts

Each of Tampa’s neighborhoods possesses a unique character that reflects the great diversity of our city. In some of Tampa’s traditionally lower-income and working-class neighborhoods, housing costs have increased dramatically over the past decade. In some cases, this has priced out long-time residents and changed the character of specific neighborhoods.

At the same time, increasing equity and rising home values can reduce income inequality, mitigate the negative impacts of gentrification, and promote opportunities for long-standing residents to build generational wealth should not be mutually exclusive goals. The Advisory Team recommended several initiatives that could mitigate the negative impacts of housing affordability.

First, designate ‘Income Source’ as a protected class to prevent the negative bias that can be associated with the use of a housing subsidy. Access to housing should be based on the ability to pay, regardless of what the source of the funds is.

Second, extend the duration of liens associated with owner-occupied rehabilitation programs to ensure the home remains affordable and discourages predatory investors from making offers to purchase.

Lastly, develop education campaigns to help vulnerable residents avoid scams and predatory investors. Several purposed programs are aimed at reducing the exploitation of vulnerable residents, such as legal aid resources to address probate issues, assistance in the legal transfer of title to living relatives, and will-writing services for low and moderate-income families.

Section 2 - Policy and Alignment¶The Advisory Team identified numerous opportunities to better align the City’s zoning and land use codes with the Mayor’s vision for a robust housing affordability ecosystem. These recommendations entail modifying – and in some cases eliminating- portions of the land development code (LDC) that either impede the path to producing affordable housing units or add unnecessary costs to projects that ultimately get passed on to the buyer or tenant.

In addition, the Advisory Team recognized that transportation and housing are the two largest household expenses for most families, and therefore, access to reliable and affordable transportation options is key to creating attainable housing, and in turn, economic growth and prosperity. For that reason, the Advisory Team’s LDC-related recommendations emphasize the need to focus on land-use changes that support Transit-oriented development (TOD) along key transit investment corridors. Transit-oriented development can include a mix of commercial, residential, office, and entertainment centered around or near a transit station. Dense, walkable, mixed-use development near transit attracts people and adds to vibrant, connected communities.

Because housing affordability and transportation are so inextricably linked, it is imperative that the City’s transportation agenda aligns with its housing agenda and that both are adopted into the City Comprehensive Plan and Land Development Code. As such, the Advisory Team provided the following recommendations.

Recommended Action Items- Evaluate the creation of ‘transition’ zoning district(s) near commercial corridors to support the City's vision for more density concentrated along the commercial corridor, but in a manner that creates a gradual transition to adjacent lower-density residential neighborhoods. Focus first on transit investment corridors where TOD should be encouraged.

- Revise Section 27-43 of the Land Development Code to better define the term ‘Housing Affordability Development’ to prevent misuse and misinterpretation, and integrate the new definition with broader Housing affordability goals. Clarifying the term will ensure that incentives targeted for housing affordability are appropriately applied. Such a definition may incorporate, but should not be limited to, an affordable housing development that qualifies for existing federal and state tax credit programs.

- Create a separate code section to emphasize the ‘affordable housing’ bonus provision currently incorporated into Section 27-140 of the Land Development Code; include several new incentives including, but not limited to, bonus density, express permitting fee waivers (as permitted by law), and parking requirement reductions.

- Assess and provide specific recommendations regarding the feasibility of inclusionary zoning under certain specified criteria.

- Assess the possibility of creating presumptions of entitlement in favor of requests for certain administratively granted variances.

- Develop exceptions to reduce the off-street parking requirements for new developments that meet certain criteria such as a) qualifying as a Housing Affordability Development or b) being located either within one-half mile of a transit stop or station with weekday service intervals of fifteen (15) minutes or less or within one (1) mile from the boundaries of the City’s ‘Major Employment Areas’ as defined in the Comprehensive Plan.

- Consider revising the Comprehensive Plan and LDC to allow limited multi-family housing development in existing single-family districts; in areas of the City that are designated for transit-oriented development; are in or adjacent to ‘Major Employment Areas’ as defined in the comprehensive plan; or are located in designated Low-Income Community census tracts.

- Revise Sections 27-132 and 27-290 of the Land Development Code to identify more areas of the City where accessory dwelling units should be allowed as a permitted use, subject to certain established criteria. Consider reducing the requirements that apply to accessory dwelling units, such as a) eliminating the requirement that an owner occupies the main residence that an accessory dwelling unit serves; b) tying maximum occupancy to per-person square footage instead of a set limit of two (2) occupants; and c) replacing the square footage limitation in Section 27-132 with a percentage limitation applicable to accessory structures set forth in Section 27-290.

- Revise the Land Development Code to allow the merging of contiguous vacant lots in existing neighborhoods to allow smaller and narrower lots than surrounding zoning, and identify specific allowances for lots narrower than the RS-50 zoning requirements.

- Consider expanding the current form-based code provisions or adding new provisions in the LDC to allow for non-traditional single-family housing types such as tiny homes, container homes, and other micro-housing options. Provisions should allow for appropriate setbacks, square footage, and height allowances that are unique and tailored to support non-traditional single-family dwellings.

- Provide a streamlined rezoning or Planned Development process whereby non-traditional single-family housing types are developed while existing housing stock is maintained within a single site plan.

- Encourage true infill development and minimize gentrification and existing resident relocations.

- Identify a pilot project that allows developers to create a ‘village’ of new and emerging single-family and small multifamily housing types that could be used as a testing ground for smaller lot allowances, incentives, relaxed requirements, and form-based codes.

Section 3 - Community Outreach and Engagement¶

Housing security is key to family wellness, community economic growth, better health, and improved schools. As this administration moves forward to address the housing needs of the community, the committee recommends that ‘Outreach and Engagement’ be paramount to every strategy to ensure success.

As the City works to increase the supply of housing affordability and the diversity of housing choices, it is important to make the public aware of all opportunities, resources, and options available to help citizens achieve housing security. Tampa is home to hundreds of non-profit agencies, housing developers, financial institutions, and government entities providing services to meet the housing needs of area residents. These efforts should be better integrated to achieve the greatest impact. The following are recommendations related to community outreach and engagement.

Recommended Action Items- Expand outreach. To ensure the widest coverage for information and input, the City should expand efforts to promote housing affordability through multiple forums such as social media, newspapers, TV, videos, newsletters, websites, etc. All outreach methods should be evaluated regularly to ensure resources are used for maximum effect and convey a consistent theme and message. Specific efforts include:

- Develop and implement a strategic outreach strategy. The strategy should include, but not be limited to the following concepts:

- Ensure consistent messaging about programs and resources.

- Utilize all media sources and citizen-facing points to ensure the widest coverage to all audiences.

- Incorporate an educational component to better inform the public on the meaning, importance, and benefits of ensuring housing security for all.

- Include regular updates on performance and results of ongoing programs.

- Actively engage the business community, non-profit organizations, local schools, and other government agencies to partner in all outreach and education efforts, including providing links to City programs and services on partner websites.

- Design outreach programs targeted at large employers to implement a continuous housing education program, e.g., Lunch & Learn, housing newsletters, etc.

- Assist in facilitating a community-based group to influence state representatives to honor the State Housing Trust Fund commitments.

- Develop and implement a strategic outreach strategy. The strategy should include, but not be limited to the following concepts:

- Simplify and Centralize Information. The City should catalog all housing assistance programs and housing affordability materials. Specific efforts should include:

- Create a central hub for consumers to easily access the programs and services that meets their needs and determine how to navigate the system effectively.

- Update and expand the ‘Housing & Community Development’ website to make it more user-friendly, including tutorial videos to help applicants with the application process.

- Review all housing information materials to ensure clear and concise messaging for the intended targeted audience and verify that the language and culture are considered for maximum community effect.

- Unify and Integrate Counseling Services. Counseling services are a key component of any housing strategy. Efforts should be made to expand the availability of these services and educate the public on the benefits of Housing Counseling as an acquisition and housing sustainability tool. Specific recommendations include:

- Expand Housing Counseling services to include locations and service delivery options with greater accessibility.

- Work with Housing Counseling agencies to expand services to include rental, foreclosure, and financial counseling.

- Maximize the use of pro bono legal services to ensure that those in need have sufficient access to expertise and resources concerning their legal rights and obligations.

- Encourage Legal Aid and similar services to advertise and promote their services, including providing brochures at various City locations.

- Co-host workshops throughout the City to assist families with title issues, renters with landlord-tenant issues, and homeowners facing foreclosure.

Housing Affordability Advisory Team Members

Co-Chair: Tyler Hudson

Attorney, Gardner Brewer Martinez-Monfort

Co-Chair: Bishop Dr. Tom Scott

Former County Commissioner and Former City Council member

Co-Chair: Bemetra Salter Liggins

Florida Managing Director, Mutual of Omaha Bank

Bret Azzerelli

Vice President, Elements Architecture Firm

Ernest Coney

Chief Executive Officer, Corporation to Develop Communities of Tampa

Marianne Edmonds

Senior Managing Director, Public Resources Advisory Group

Pete Edwards

Community Advocate

Harry Hedges

Managing Director, H&R Properties

Sul Hemani

Vice President, Business Relationship Manager, Chase Bank

Mickey Jacob

Principal, Design Studio at BDG Architects

Peter Leach

Senior Vice President, Southport Financial Services, Inc.

Yvette Lewis

President, NAACP Hillsborough Branch

Machelle Maner

Vice President of Community Development, Wells Fargo

Leroy Moore

Senior Vice-President/Chief Operating Officer, Tampa Housing Authority

Debra Reyes

President and Chief Executive Officer, Neighborhood Lending Partners, Inc.

Darrell Robertson

Chief Relationships Officer, New York Life’s Tampa operations

Rebecca Snyder

Senior Vice President, Residential Asset Strategy

Antoinette Triplett

Chief Executive Officer, Tampa Hillsborough Homeless Initiative Chairwoman, Tampa Hillsborough Continuum of Care

Jim Weiss

Tampa City President, Fifth Third Bank

Appendix A - Federal HUD and State Income Limits

Federal HUD and State Income Limits (PDF)

Appendix B - Common HUD Terms and Acronyms

Acronym definitions Acronym Definition AAP Annual Action Plan ADA Americans w/ Disabilities Act AFFH Affirmatively Furthering Fair Housing AI Analysis of Impediments (to fair housing); a part of Consolidated Plans AMI Area Median Income CAPER Consolidated Annual Performance and Evaluation Report CDBG Community Development Block Grant (CPD program) CDC Community Development Corporation CHDO Community Housing Development Organization. Nonprofit housing providers receiving a minimum of 15% of HOME Investment Partnership funds

CoC Continuum of Care approach to assistance to the homeless Continuum of Care Federal program stressing permanent solutions to homelessness Con Plan Consolidated Plan; a locally developed plan for housing assistance and urban development under the Community Development Block Grant and other CPD programs COT City of Tampa CPD Community Planning and Development (HUD Office of) CRA Community Reinvestment Act DAP Down payment Assistance Program EA Environmental Assessment. Analysis to determine the effect of a project on the environment. May lead to an Environmental Impact Statement (EIS). ESG Emergency Shelter Grants FY Fiscal year HCD Housing and Community Development HOME Home Investment Partnerships HOPWA Housing Opportunities for Persons with AIDS HQS Housing Quality Standards HUD U.S. Department of Housing and Urban Development HUD-VASH HUD-Veterans Affairs Supportive Housing program LIHTC Low Income Housing Tax Credit NSP Neighborhood Stabilization Program PHA Public Housing Authority PJs Participating Jurisdictions (in HOME program) PY Program Year REO Real Estate Owned RFP Request for Proposals. Used to solicit proposals for contracts under the negotiated procurement method. RFQ Request for Quotations. Used to solicit price quotes under the simplified acquisition procurement method. Section 3 Obligates access to jobs and contracting opportunities created by federal funding for PHA Residents and/or a low-income area resident SHIP State Housing Initiative Program TA Technical Assistance TBRA Tenant-Based Rental Assistance THA Housing Authority of the City of Tampa THHI Tampa Hillsborough Homeless Initiative UPCS Uniform Physical Condition Standards USDA U.S. Department of Agriculture UW United Way VA Veterans Affairs (U.S. Department of) VASH HUD-Veterans Affairs Supportive Housing Program W/MBE Women and Minority Business Enterprise - Increase the supply of Housing Units