Atlantic Hurricane season officially runs from June 1 through November 30, and it is crucial for business owners and managers to adopt a comprehensive preparedness strategy in order to recover swiftly after a storm.

America’s SBDC – Protect Your Business¶

Businesses encounter emergencies in various forms, including natural disasters, fire, medical crises, power outages, security threats, or data breaches. Conducting a thorough evaluation of the business’ physical and operational risks can provide valuable insights that help entrepreneurs identify risks and take steps to mitigate the potential losses, as a result of a disaster. There are online tools and consulting services available to help businesses develop an emergency and recovery plan:

As a primary responder in the state’s Emergency Support Function (ESF) 18 for Business & Industry, the Florida SBDC Network plays a critical role in supporting disaster preparedness, recovery, and mitigation through its business continuity services. Their certified business consultants offer free consulting and training events to help you minimize impacts of natural and man-made disasters.

Every business should have a Business-Ready “Records-To-Go” box containing essential documents and supplies necessary for continued operations after a disaster. Make sure the box is fire and waterproof.

Suggested records include:

- Business continuity, emergency preparedness, and disaster recovery plan

- Emergency contact list of employees and key customers

- Insurance policies and agent information

- List of suppliers and vendors

- Back-up computer systems and data files

- Bank records

Communicate key aspects of your plan to your business partners, employees, suppliers, family, and clients to ensure everyone is aware of their responsibilities during an emergency.

To begin your emergency and recovery planning, complete a Request for Consulting to schedule time with a consultant.

Online Planning Resources:¶

- Florida Disaster- Planning for Businesses

- Ready.Gov- Ready Businesses

- Homeland Security- Prepare My Business for an Emergency

- Small Business Administration- Prepare for Emergencies

Take Immediate Action After a Disaster¶

After confirming that your family, employees, and key stakeholders are safe; it is time to execute your recovery plan. The first step will be to assess your property and financial damages and complete the Business Damage Assessment Surveyto ensure that state and local agencies are aware and prepared to support you through recovery. City of Tampa employees will communicate with and provide guidance to Tampa-based businesses immediately after the emergency.

Disaster Assistance¶

Florida Small Business Emergency Bridge Loan Program ¶¶

The Florida Small Business Emergency Bridge Loan Program offers short-term, zero-interest working capital loans that are designed to cover the period to between when a disaster impacts a business and when the business has secured long-term recovery funding, such as federal or commercial loans, insurance claims, or other resources.

Visit FloridaJobs.org/EBL to learn more about the program.

Call 1-833-832-4494 or email EmergencyBridgeLoan@Commerce.fl.gov for more information on the Florida Small Business Emergency Bridge Loan Program.

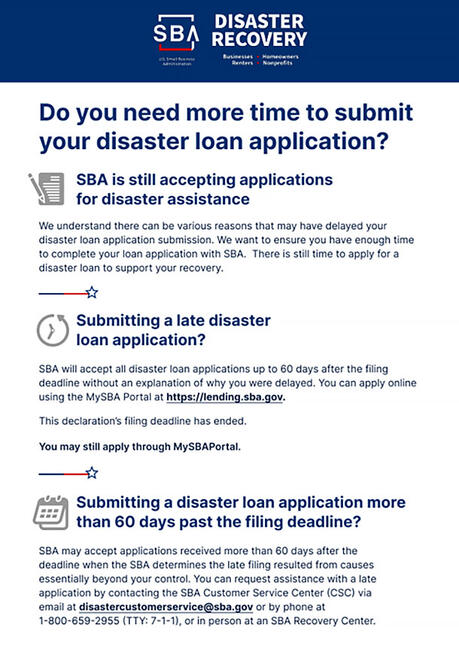

Small Business Administration Disaster Assistance¶

The U.S. Small Business Administration (SBA) Funding Programs provide permanent financing for mitigation, physical damage, economic injury and military reservist employers. These loans offer favorable rates and terms to cover losses that are not reimbursed by insurance or FEMA.

Currently Available SBA Financing¶

Mitigation Loans are available to homeowners and businesses impacted by declared emergencies. Disaster loan recipients can increase their funding by up to 20% to help finance property improvements to reduce the risk of future damage. Businesses and residents in the Tampa Bay area are eligible to apply.

Currently activated SBA loans include: Physical Damage Loans and Economic Injury Disaster Loans (EIDL).

Deadlines for filing loan applications:

- Hurricane Milton: Physical Property Damage: 12/10/24; Economic Injury 7/11/25

- Hurricane Helene

Submit applications online using the MySBA Loan Portal at www.lending.sba.gov.

Please contact SBA’s Customer Service Center by email, www.disastercustomerservice@sba.gov, or phone, 1-800-659-2955.